Published: May 2025

Some ETPs serve particularly well to demonstrate interesting quirks related to trading. Many articles have been written about UVIX for instance to demonstrate the costs related to index tracking. Grayscale’s BTC provides a great exercise to understand the ETP issuance space and the challenges of trading on-chain assets in off-chain wrappers.

Background

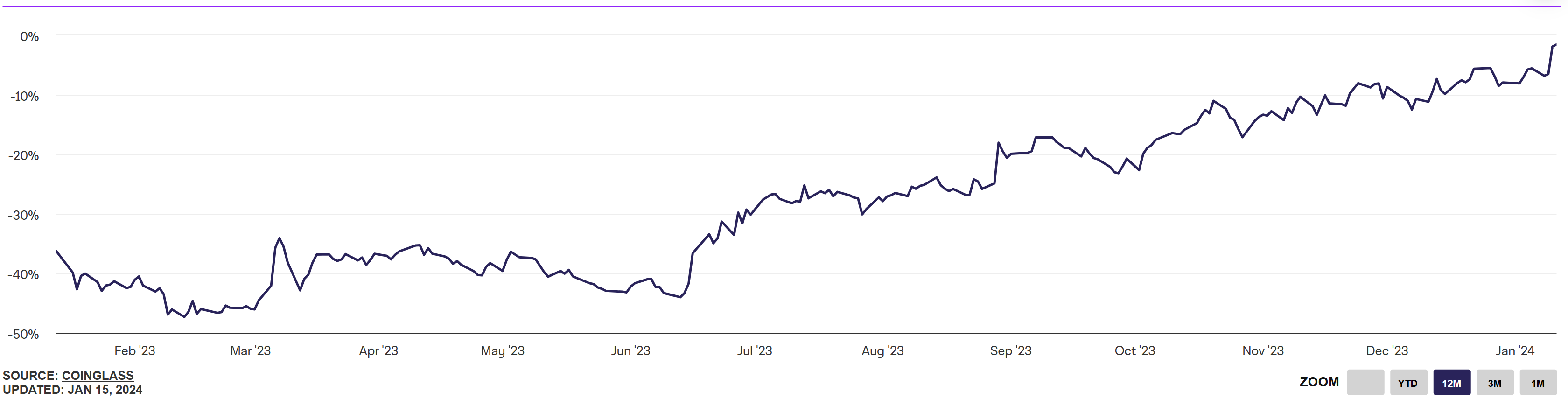

For years, Grayscale held the largest publicly traded equity to gain exposure to Bitcoin. The fund, GBTC, was a closed-end ETP. With massive investor interest in crypto, GBTC as well as many other Grayscale funds received massive inflows, but these products could not be made “open-ended” due to regulatory restrictions. As a result, GBTC traded at large premia and discounts. In the year before being “opened” following regulatory approval, the fund traded close to 50% discount, basically constituting a prohibitive cost to get out of the position. If investors got short shares, they risked getting a Reg. SHO notice requiring they buy shares, so they were forced to sit long, which is why bids were so low (discount). Investors discounted the fair value by the expected holding cost, which is why we see a convergence to fair value around opening. The principles demonstrated by GBTC show the importance of an effective creation/redemption mechanism on fair value pricing.

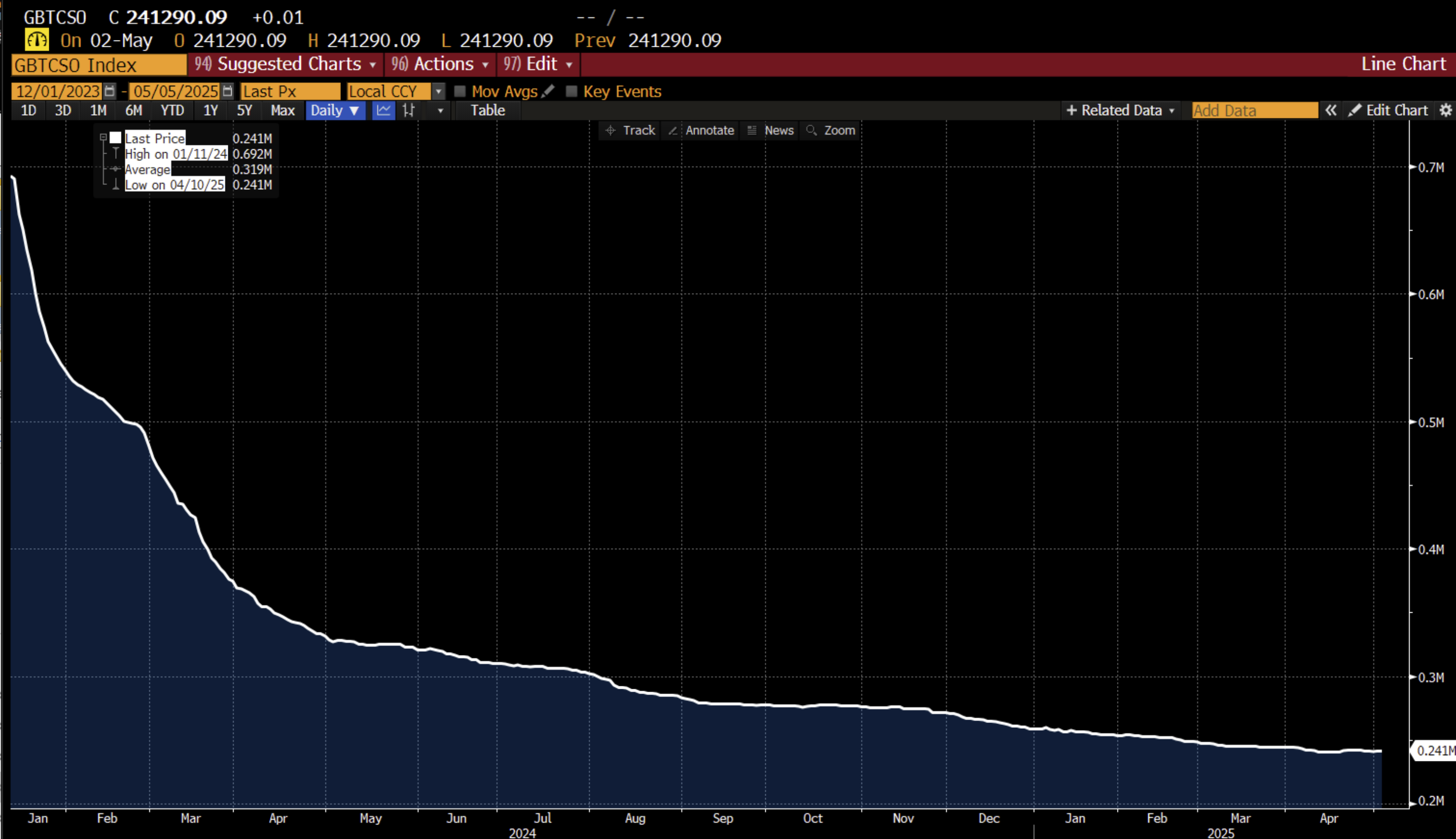

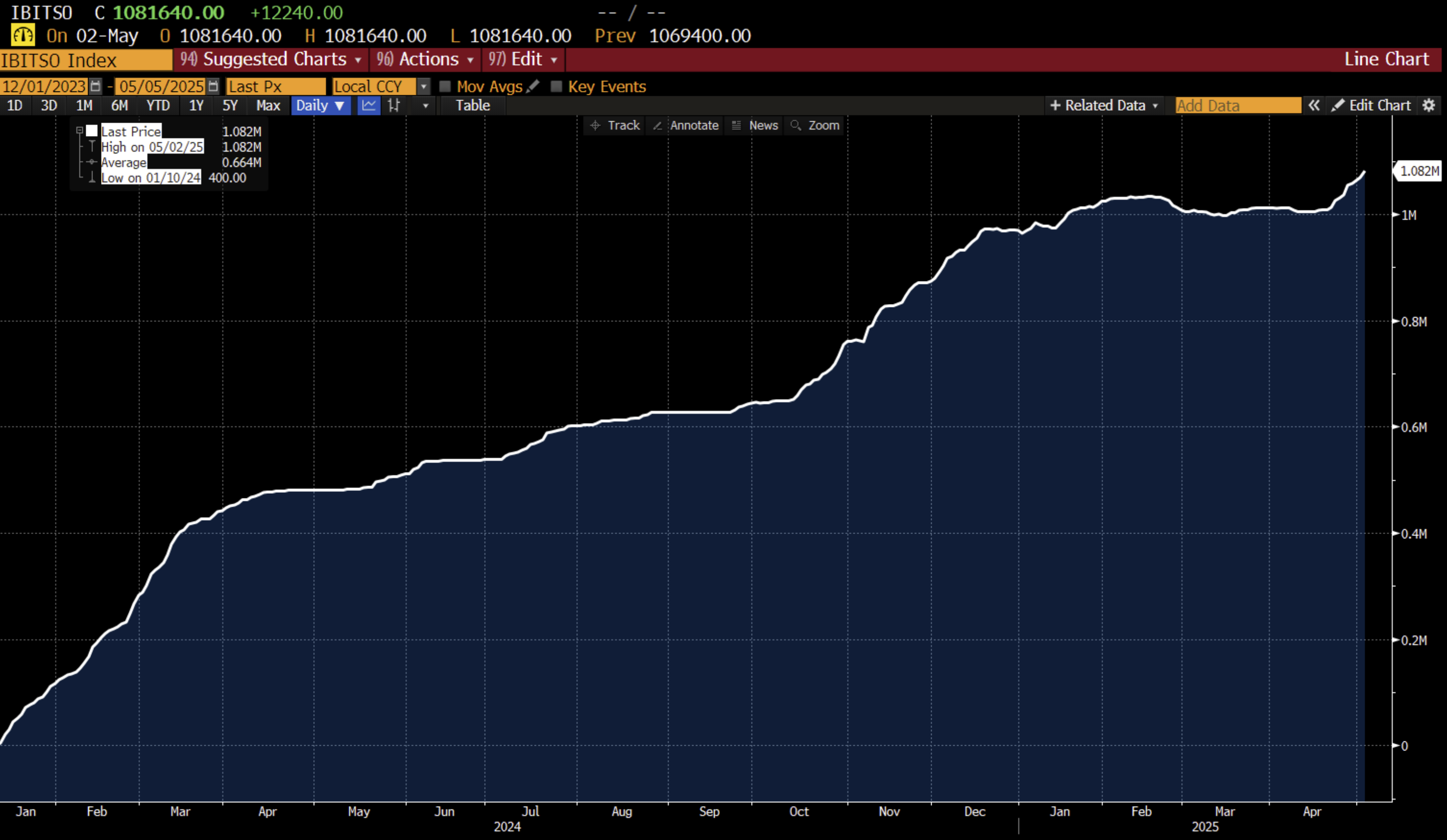

Eventually, on January 10, 2024, eight other spot Bitcoin ETPs received regulatory approval to begin trading, and this cohort of nine all were traded “open” resulting in each trading far closer to NAV. GBTC charged the highest fees at the time of listing and received steady outflows of AUM, costing Grayscale huge sums of money. To reduce costs, they limited redemptions daily which explains the long decay in their holdings.

Long prior to the listing of spot bitcoin funds, Grayscale had claimed the rights to the ticker BTC (notably not the currency!), and decided to spinoff the fund with a lower expense ratio than GBTC to help stem outflows. The spinoff was seeded by 10% of the GBTC assets, resulting in a much smaller fund. They did the same with their Ethereum fund ETHE spinning off ETH. The smaller funds were advertised as costing “less than a Big Mac.”

Initial Trading

With the expense ratio in line with the market, BTC did not suffer from outflows like GBTC. While rival funds had to compete to build AUM, BTC already had ample assets due to the spin-off. The question was whether institutional investors would hold it. With the low notional, retail investors liked the product, resulting in pretty decent inflows. The low handle we believe represented an attempt to rival mutual funds at one of their few advantages over ETPs: the ability to invest any amount of money rather than multiples of ~$50 as is the case with other crypto funds.

Nonetheless, the managers of the fund realized something was wrong, as evidenced by its resulting reverse split. The stated reasoning—”Reverse share splits can help make the trading of securities more cost-effective for market participants, and that is what Grayscale intends to do for BTC and ETH”—was quite vague. We will dissect the reasoning for this split below, describing benefits, drawbacks, and alternative solutions.

Comparative Analysis

These are all ETPs that hold spot Bitcoin, with slight differences. Below we summarize:

| Fund | Issuer | Expense Ratio | Index Methodology | Approximate AUM (as of May 5, 2025)* | Approximate Handle (as of May 5, 2025)** |

|---|---|---|---|---|---|

| ARKB | Ark Funds | 0.21% | BRRNY | ~$4B | ~$90 |

| BITB | Bitwise | 0.20% | BRRNY | ~$4B | ~$50 |

| BRRR | CoinShares | 0.25% | BRRNY | ~$6B | ~$30 |

| BTC | Grayscale | 0.15% | CBX | ~$4B | ~$40 |

| BTCW | WisdomTree | 0.25% | BRRNY | ~$0.1B | ~$100 |

| FBTC | Fidelity | 0.25% | FIDBCRP | ~$19B | ~$80 |

| GBTC | Grayscale | 1.50% | CBX | ~$18B | ~$70 |

| HODL | VanEck | 0.20% | BBR | ~$1B | ~$30 |

| IBIT | iShares | 0.25% | BRRNY | ~$58B | ~$50 |

*Rounded to nearest billion **Rounded to nearest $10

BRRNY: CME CF Bitcoin Reference Rate - New York; CBX: CoinDesk Bitcoin Price Index;

FIDBCRP: Fidelity Bitcoin Reference Rate; BBR: MarketVector Bitcoin Reference Rate

So based on the above table, we see that GBTC has very high fees relative to the other funds; for the most part the other funds have similar fees. At its peak, GBTC held around ~$46B, but investors rotated into cheaper options. The majority of investments moved to IBIT, despite for example BITB having a cheaper expense ratio but similar handle and index methodology. Unlike most of these funds, IBIT needs to be created/redeemed the day prior to the NAV stamping (page 70) meaning that market makers need to commit more capital to trading IBIT. Despite these weaknesses, IBIT has amassed considerable assets due to the importance of issuer networks. Investors rely extensively on BlackRock for asset management so the issuer can drive demand. Smaller issuers need to compete to sell their own products, explaining the lower fees offered by ARKB and BITB.

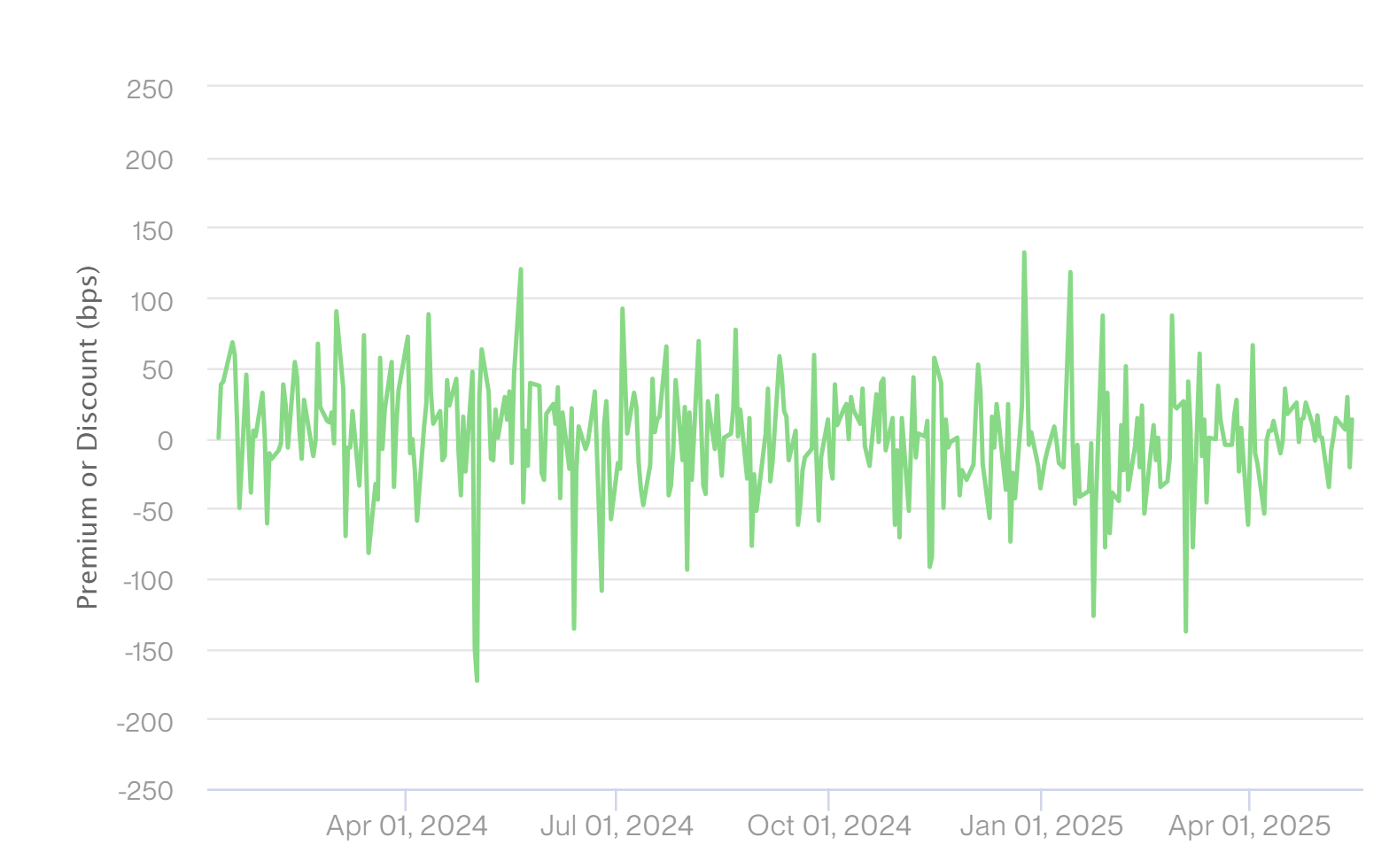

Interestingly, all these funds regardless of liquidity trade at various premia/discounts since crypto market makers charge the funds to purchase/sell Bitcoin which comes with its own costs, leading all of these funds to have similar but large premia/discounts. BITB has average daily trades of 1M shares, IBIT of 44M; both have an average spread of one cent. Despite IBIT’s greater liquidity, the premia/discounts are practically identical because they reflect the cost of wrapping a crypto asset in a traditional finance rail. The more products in the basket, the greater these costs are to end investors. We believe reducing these costs, which will exist for RWAs and memecoins alike are one of the most important challenges necessary to innovate ETP markets.

Now to BTC: This fund has the lowest expense ratio and before the reverse split, shares hovered around $6. That means that to enter positions, investors had to pay half the spread of the shares which was around 20bps. Grayscale was correct that the reverse split would increase efficiency because investors with a fiduciary duty might not be able to allow that transaction cost to excuse slightly lower fees. This reflects an inherent tension in tick size constrained markets with investor accessibility. BTC was created with a low handle to appeal to retail investors who might not want to only purchase Bitcoin exposure in increments of $40-$50, but low handles are unappealing to institutional clients.

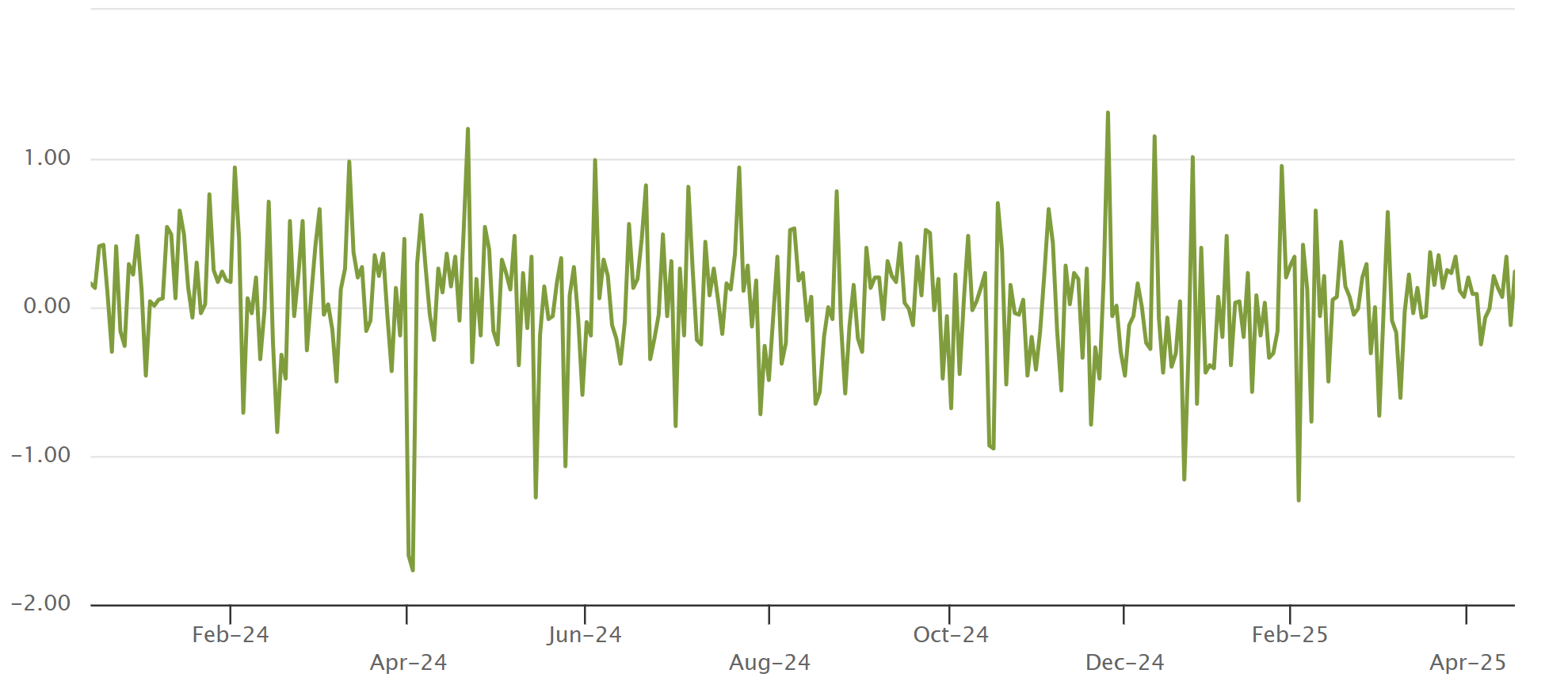

Before the reverse split, there weren’t really any outflows of BTC. Funnily, since institutions that held GBTC were given BTC, many could not exit their position due to the tick size constraint. Following the reverse split, BTC was redeemed many times while other funds had inflows (November/December below) as it was much cheaper to sell than before.

Lessons

From the trading of BTC, we can draw a few conclusions that should be followed as passive investing moves on chain

- Tick size constraints impact investors ability to modify positions; a penny spread can sometimes be a prohibitive cost

- Low handles are desirable for retail investors, but not institutions

- Low tick sizes on crypto exchanges actually provide the opportunity to reconcile these demands

- The lower pricing increments actually reduce competition for time priority and instead demand better pricing, increasing efficiency of markets

- Issuers source liquidity; first-mover advantage and price competitiveness are less important than the networks individual investors control

- The large premia/discounts observed in crypto ETPs are systemic

- Closed-end funds, regardless of quantity or type of components, trade at massive discounts

- Open-end funds oscillate between huge valuation changes around fair due to underlying traditional finance rails; these costs can prevent otherwise beneficial transactions