Published: April 2025

In this paper, we discuss the importance of indices to market makers, issuers, and market efficiency.

Introduction

Indices like the S&P 500, Nikkei 225, LBMA Gold Price PM, and the Fidelity Bitcoin Reference Rate all serve to benchmark sector performance. To the uninformed, these indices can appear to be an academic attempt at summarizing US, Japanese, gold, and Bitcoin markets. Maybe they look just like mere lists of securities, or not really anything more important than advertising pitches to create ETPs and structured products. Index providers—while frequently academic in nature—actually play an extremely important role in finance. In this article, we will speak briefly about the importance of indices, how they have transformed markets, and ways that new indices can pave the way for a more robust crypto asset market.

Importance for Issuers

When passive investing was created, fund managers worked to diversify idiosyncratic risks away by investing in many securities in different proportions. At first, these funds were necessarily actively managed, meaning all investment decisions were made by the asset management team. Funds could be compared to one another, but as individual investors struggle to identify the best trades, so too could fund managers. A counterfactual portfolio was needed to measure fund performance with rules-based interventions, and indices were created to do just this; they provide a demonstration of a broad swath of the market without manager intervention. Nonetheless, a fund manager working to secure income has different goals than a fund manager aiming for growth. To evaluate the performance of managers and create a baseline for different markets, many indices were developed. Today, index creation is still a complex and lively industry, with professionals working to create indices in new markets with evolving construction criteria. In many cases, these indices eventually turn into mutual and exchange-traded funds, providing opportunities for issuers to profit and investors to cheaply track market segments.

Index Traits

There are scores of indices across all asset classes. Some vary only slightly, while others have big differences that can have a large impact on their performance. The role of index providers is to conduct research into historical trends to identify strong areas for future benchmarking, often providing analysis into different aspects of rules. Here are some choices index providers can decide that have significant impacts on trading.

Corporate Actions

When a public company wants to return funds to their investors, they will pass along a dividend. Indices that include such equities have to answer how this cash impacts the performance of the fund. Some indices decide to reinvest this cash in the index, which actually serves to reduce the impact of the dividend issuing company on the performance of the fund (only a fraction of the reinvested money would go to the performance of that equity). Others simply ignore the cash and track only the share itself, meaning that dividends have a negative impact on the performance of the index. The latter funds eventually will issue a dividend themselves. Properly accounting for dividends is very important to traders. Likewise, fixed income instruments, whether they are bonds or interest bearing tokens, have similar impacts, as do spin-offs. These values all impact index performance and predicting their impact on underlying assets creates opportunities to profit.

NAV Calculation

Each index has a price that can be calculated at any given time period, but these funds need to specify a specific way of calculating a fair value for a day (or given time period if calculated for instance every eight hours). For some indices, the closing auction value on a specific exchange day is used to calculate the fair value as in equity indices like the S&P 500, Nikkei 225, and even the LBMA Gold Price PM. Between these indices, however, there are differences. For the S&P 500, for instance, the stamping price is deterministic at 4pm ET (on full market days), whereas for the LBMA Gold Price PM index, the auction goes through multiple rounds until all trades clear. This has major impacts on trading, as traders hoping to replicate the S&P 500 can simply put in auction orders, but traders hoping to replicate the gold index cannot unless they are IBA participants. This distinction can have great impacts on trading.

Other indices, such as the Fidelity Bitcoin Reference Rate are calculated over a given period of time. Over this period of time, index providers can specify whether they want to use time-weighted or value-weighted average pricing, again making independent replication challenging.

Where things can get quite interesting is indices with components on many different exchanges. Consider for instance the Quantix Commodities Index or the MSCI Emerging Markets Index. The former tracks the performance of a basket of commodity futures at various weights. Futures do not have auctions, so valuing the price of a corn contract for instance on a given day is subject to time weighting between 13:14-13:15 CT (on a full trading day). Not all commodity futures settle at the same time, so the NAV value becomes more deterministic as more futures settle, such as many energy contracts later at 13:28-13:30 CT. Nonetheless, some of the commodities are traded on US exchanges like CME whereas others are located on LME. CME is subject to US holidays whereas LME is subject to UK holidays. For this reason, some indices cannot be calculated on a daily basis, which again has an impact on trading. The MSCI Emerging Markets Index tracks equities from around the world and functions similarly, but the underlying equities do have auctions when their markets are open. Choosing the fair value when markets are closed can lead to significant lags in index valuation, making pricing during these events very profitable.

Rebalancing and Weighting

Some funds rebalance daily, some funds never rebalance. Some funds select components by strict rules, others select components by committee or active management. For indices like the S&P 500 VIX Short-Term Futures Index, rebalancing is done daily, creating large slippage costs for traders hoping to replicate it. Other indices rebalance quarterly or monthly. Rebalancing time can be instantaneous (S&P 500 for instance) or over a series of seconds (like the GMCI indices) or days (like some USBF indices). There are many rules and committees that determine entry and removal from indices, related to underlying characteristics like liquidity.

The components of a fund can also have their weight rebalanced depending on the index construction, where components can be market-cap weighted, price weighted, equal weighted, or any other methodology.

Market Impacts

Before going into specific ways indices are important to market function, we should also acknowledge market and behavioral inefficiencies related to their creation. Under efficient market assumptions, securities are accurately priced based on their fundamentals. Nonetheless, addition to a major index results in outperformance over similar securities. Through addition to an index, a security receives more attention and becomes more liquid and psychologically valuable. Simultaneously, these securities also become more highly correlated to their index than their weight in their index would imply. Each quarter, for instance, when stocks enter the Russell 2000 or Russell 1000, there is a lead/lag relationship for other indices resulting in arbitrage opportunities.

By pointing these idiosyncrasies of markets, all we hope to express is that indices have the ability to shape markets. In the following, we express more significant impacts of index creation, demonstrating the importance of indices in markets.

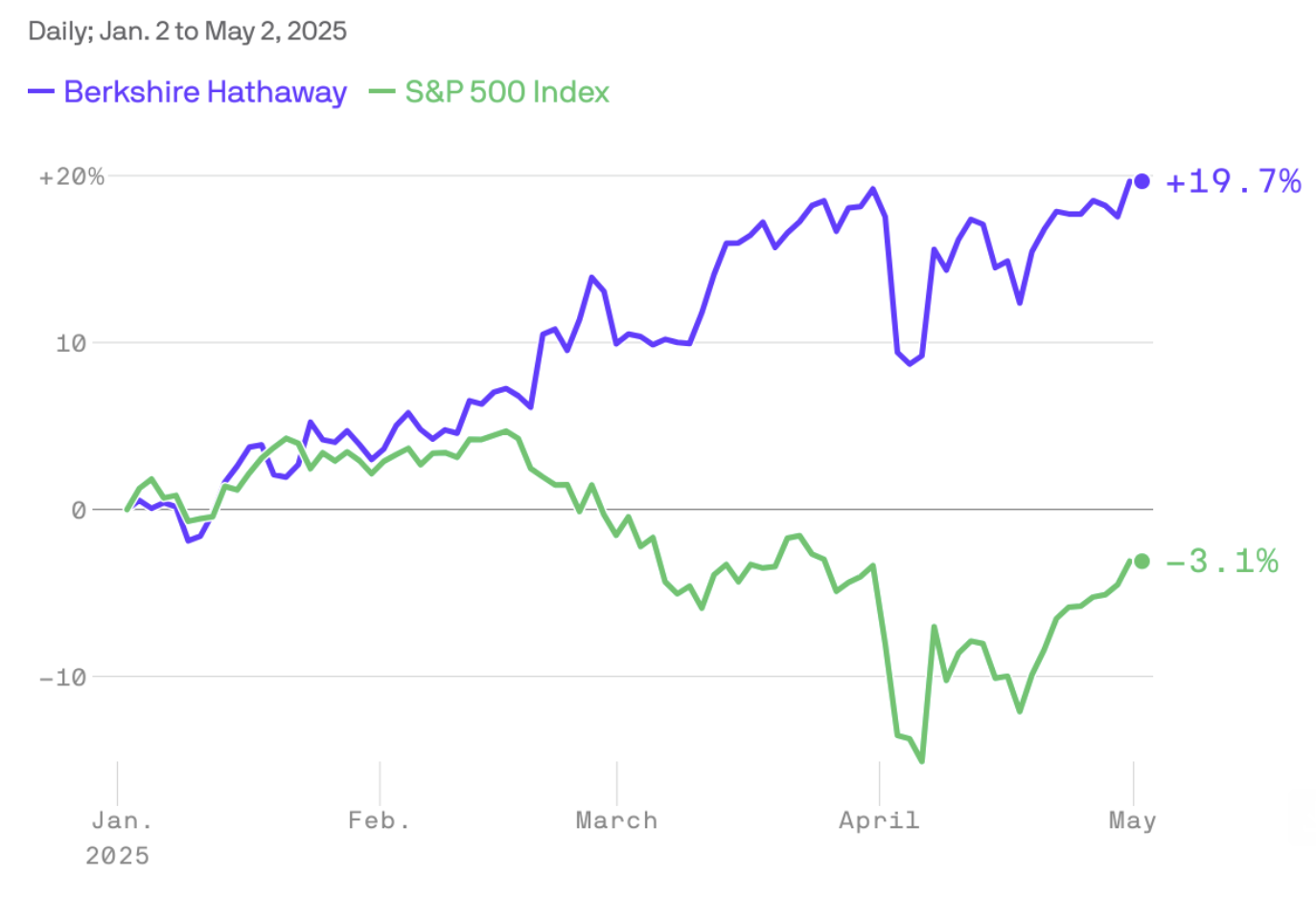

Benchmarking

Frequently, funds will hope to replicate the performance of indices with unique trading strategies. Consider the Aperio team at BlackRock and asset management team at Goldman Sachs. These are massive, industry leading teams in the tax-lose harvesting space. Each accounts for significant profits according to financial statements. The way these funds work is investors identify an index of interest, whether it is the S&P 500 or Russell 2000, and ask their manager to track its performance. To do so, they identify a subset of stocks they expect to track the index without duplicating highly correlated stocks, for instance, Pepsi and Coke. When Coke is down, they sell it and substitute Pepsi, ensuring that investors in general are tracking their chosen index but receiving tax losses. The way these firms compete is by benchmarking their returns to the given index. With this strategy of choosing a small subset, they necessarily cannot track the index perfectly. Some years this strategy loses money (like when the market does) in notional terms, so the only when to measure a job well done is by demonstrating that the strategy did not do worse than the market.

There are many other forms of benchmarked strategies, but in summation, each simply aims to demonstrate value without underperforming the market. For this reason, the index business and the public’s perception of it as “the market” means that it serves a psychologically important role which also results in big business. Aperio for instance holds over $120B in assets on a strategy that is built around index tracking.

Fees

The famous hedge fund fee is the 2/20 schedule, meaning a fee of 2% on the AUM and 20% for performance above a specific threshold. This performance fee provides an incentive for managers to spend their time working on investing instead of growing AUM. To determine the value of outperformance, some funds set a predetermined schedule, whereas others set their fees to an index. A long/short equities portfolio is likely compared to market indices like the S&P 500 or Nikkei 225, but trading equities should not be benchmarked to gold performance. Likewise, cryptocurrency funds are much more volatile than most other assets, so investors should want a clear index to benchmark their returns; a fund with perverse incentives for instance could invest in BTC and hope for outsize returns if they only need to beat a return threshold of say 8%, as the massive movements in the spot price could make this easy and the fund does not suffer from downside risk (as far as there are lockup provisions). To garner trust and flows into crypto fund space, proper benchmarking is necessary to ensure the fee structure is palatable to investors.

Risk Allowance

Similarly, if a pension fund for instance is interested in investing in crypto assets, each investment needs to be evaluated against a risk budget. Pensions are inherently risk averse; even though they hope to diversify into new spaces, they have a very short leash for unnecessarily risky assets. Even with a small pool earmarked for crypto, comparing any asset to established risk metrics such as models based on the S&P 500 results in alarm bells for risk officers. Crypto assets can have outsized returns but the volatility prevents investments under established metrics. In order for traditional funds to properly measure the risk-weighted return of an asset, they need a proper index. We believe that when an S&P 500 equivalent becomes established for crypto assets and their different subsectors, more institutional interest will be possible because more standardized risk metrics can be developed.

Liquidity

An index on its own is basically just a well-researched whitepaper. They are inherently impossible to replicate because they do not account for various fees, for instance. In reality, when someone wants to invest in the S&P 500 for instance, they need to buy products like the Fidelity 500 Index Fund (a mutual fund) or SPY (an ETP), both of which likely underperform their benchmark due to various trading costs and fees. You can read our primer on passive investing to understand the difference between the two, but we believe instruments like these help build index credibility. There are network effects from inflows into funds that hold these instruments and the belief that these indices are the “market” in general.

Many novel indices are noted to outperform more popular ones over historical time horizons, leading to debate over the “best” ones, but in reality the best ones are the ones people invest in. Index providers only succeed when the volume of assets tracking their index grows. For this reason, ETP issuers, market makers, and index providers are all linked with shared incentive to create better, more tradable products. We believe, as stated in our passive investing primer, that ETPs have opportunities to improve, helping each of these parties.

Cryptocurrency Indices

In traditional finance, indices receive great import from a variety of parties. Providers such as S&P Global and MSCI are large companies that are constantly growing new offerings, including into the crypto space. We believe that a necessary step to help crypto assets develop credibility is the adoption of benchmarks for the crypto space. Bitcoin and Ethereum mainly serve this role currently, but there is a reason every stock isn’t compared to Nvidia or Ford. New entrants are working to create tradable versions of these indices such as perpetuals of the CoinDesk20 and GMCI 30, but a perpetual contract is not suitable to grow assets under management, a necessary component we believe to receive trust and a psychological anchoring.

There are many attempts to develop these passive products, but we believe they are inhibited by dependence on traditional finance rails. As we continue this essay series, we hope to outline where we believe we can lead to a paradigm shift in the trading of these indices, which should excite crypto investors and the passive trading ecosystems alike.

Conclusion

Indices are fundamental to markets. They help provide a measure for performance that shapes how investors make decisions, particularly related to risk allowances. The establishment of a trusted index is necessary to expand trading into new asset classes. Creating benchmarks for crypto assets is the next step for the space to become sufficiently established.