Published: June 2025

The purpose of this article is to enumerate the different ways investors can gain exposure to indices. Through our extension to digital assets, we argue to issuers why developing on-chain basket products creates a desirable product to investors without needing to appeal to the opportunity to receive fees in untapped markets.

Introduction

If I am an investor who wants to invest in the S&P 500, how could I invest? There are plenty of potential instruments. I could buy an option or a mutual fund, for instance. If I want exposure that varies linearly with the index, I can disregard options. If I want exchange trading capabilities so I can easily enter/exit positions, I eliminate mutual funds. Still, I have three choices:

- Futures - e.g. CME-listed E-Mini S&P 500 Futures

- ETPs - e.g. SPY, IVV, VOO, SPLG

- Physicals - literally the 500 equities that compose the S&P 500

These choices come with key differences and notably none is literally the S&P 500 index. Indices exist solely as a white papers, as they cannot be perfectly replicated due to market frictions (rebalancing comes with fees, for instance). The most liquid option and the one with the most trading hours is the futures contract. Futures settle instantly, provide leverage, and expire, meaning traders must roll their position. Rolling costs and interest rate exposures make these not necessarily the best way to track an interest over long time horizons.

ETPs are the next most liquid option for trading. They have relatively small, deterministic costs which make them suitable for long-term holding despite their management fees. Many organizations such as pensions might have mandates restricting their ability to purchase futures so they turn to these instruments. The last option is to simply buy all the underlying stocks. Downsides from this option are the complexity of purchasing so many individual equities, the high costs related to these purchase (SEC fees, FINRA fees, exchange fees, spreads crossing, etc.), and the challenge of updating the basket with each rebalance. Sophisticated investors might choose this option to avoid paying management fees, but physical replication is mainly used for arbitrage rather than short- or long-term investment.

The three-legged arbitrage between these types of instruments has led to booming fortunes for myriad market makers and hedge funds. As ETPs move on-chain, we imagine these types of arbitrage opportunities for indices such as the CoinDesk 20 will continue to exist, though we briefly want to consider the advantages of a fourth stylized option.

Wrapped on-chain ETP

Let us consider a world with on-chain ETPs and off-chain ETPs where the most liquid of these ETPs tracks both on- and off-chain track the CoinDesk 20 index. We have a few different methods for investing in this index yet again:

- Perpetual contracts - e.g. the CoinDesk 20 perpetual that currently trades on Bullish

- Physicals - the 20 tokens that comprise this index

- ETPs - these are more complicated. We have a few options here too

- Fully on-chain token that holds the 20 underlyings

- Off-chain ETP that holds the 20 underlyings

- Off-chain ETP that holds the on-chain token ETP

We have the same breakdown for these asset classes in general as before. Conducting physical replication is costly and not a likely decision for most investors. Perpetuals, as with futures, do not serve as strong long-term holding options as they charge fees on holdings.

As a brief aside, we will not that not all indices or ETPs have associated futures/perpetuals. When these products exist, they generally make trading cheaper, particularly with digital assets which are difficult to short. Regardless, this point does not have any impact on our discussion of relative cost of each asset.

As before, most investors will likely choose to transact in ETPs, though here we have three distinct options. In each case, issuers will charge management fees, though in option 3 we can expect two sets of fees: one for the underlying ETP (option 1) and the second for the off-chain wrapper. Clearly, option 1 is better than option 3. Nonetheless, some investors might not have access to trade digital assets, so a product like this might exist.

Let us next compare option 1 and option 2, each which hold all underlying assets. In our example, we will stylize management fees to be identical between each fund, though we imagine in reality the costs associated with a traditional finance fund would be more costly for reasons discussed here and here. Additionally, we will assume trading costs are identical on- and off-chain though again off-chain costs (exchange and regulatory fees) are higher due to intermediaries in reality. With all these simplifying assumptions, we can still determine which product is cheaper for end investors.

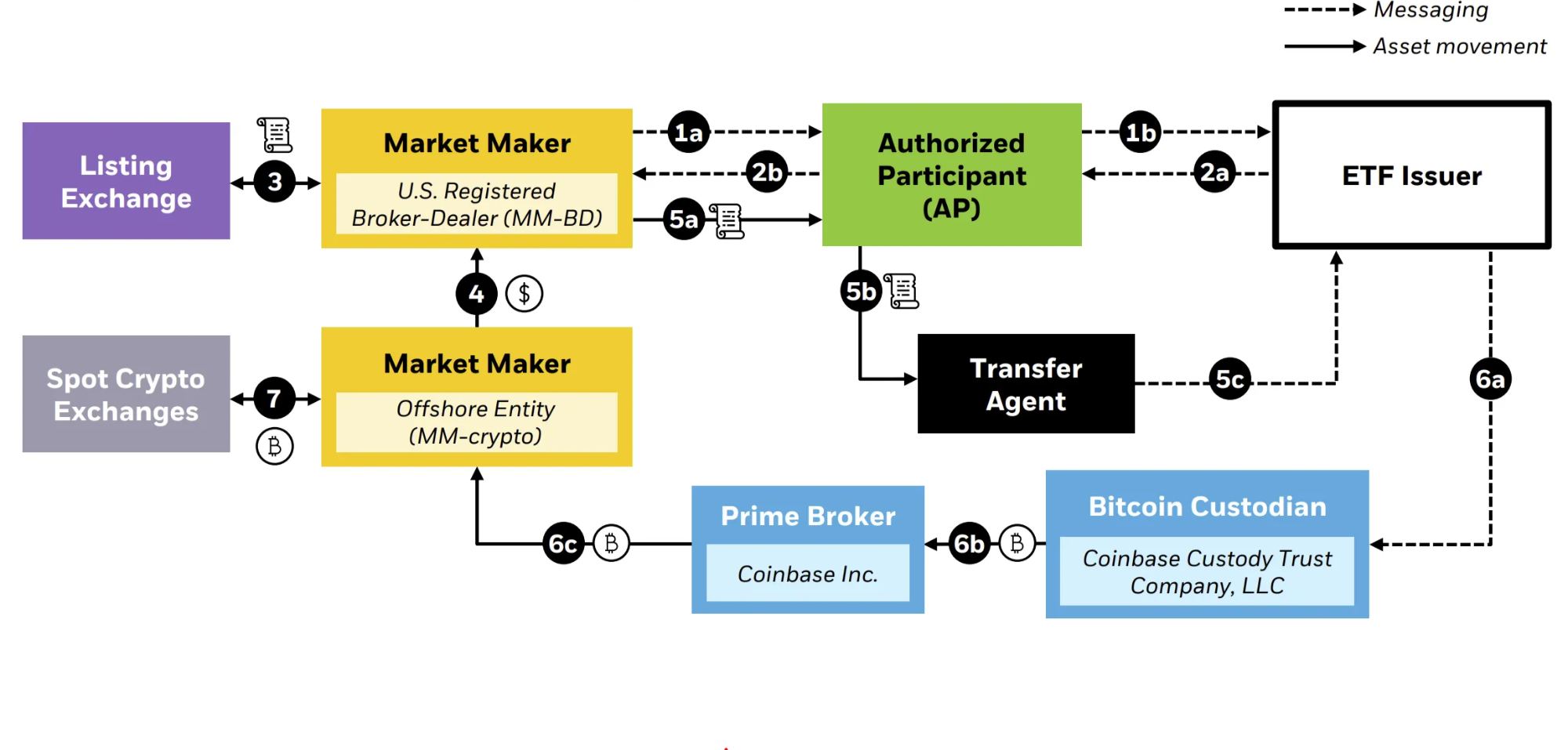

The remaining cost associated with trading these products is the bid/ask spread, which is a reflection of market maker trading costs, namely creation/redemption costs. If done off-chain, the market makers need to go through many intermediaries as shown above (basically transfer agents and clearing corporations) that charge fees. Whether in-cash or in-kind, we believe these fees can be eliminated by taking advantage of smart contracts and decentralized ledger technology, making option 1 cheaper than option 2.

Not every trader or institution is willing to trade on-chain for example due to fears over losing primary keys or regulatory restrictions. Consequently, we must compare our two off-chain ETPs (options 2 and 3). Even with option 3 containing an additional management fee, the significantly fewer transactions (purchase of 1 underlying ETP vs. 20 underlying tokens) results in far lower costs than option 2. We can see these assumptions play out in current financial markets as the spread on SPY/IVV/VOO/SPLG are tighter than many of their underlyings.

Following this discussion, we can see from our hierarchy that the existence of an on-chain tokenized ETP makes passive investing in crypto assets cheaper. As more products move on-chain, investors and institutions will rely on products like these to improve their ability to gain crypto exposure.

Conclusion

As more products move on-chain, more investors will look for passive exposure to crypto assets and indices. For those wanting the best long-term method for trading, investors will turn to basket products. The potentials for baskets expand with crypto-rails, and the cheapest options for trading both on- and off-chain require the creation of a tokenized ETP on-chain (option 1 above). This highly stylized example above fails to consider many other costs associated with creations/redemptions such as perpetual funding rates, auctions for rebalancing/conducting transactions, and authorized participant fees. Regardless, by filling in these details (some to be sketched in our creation/redemption article) we come to the same conclusion: we need on-chain passive investing vehicles.