Published: June 2025

In this article, we discuss various traditional finance intermediaries. We allude to regulations but do not treat any of them in deep detail. Instead, we want to share how different financial entities create costs for investors and explain which we believe will or will not exist when markets embrace digital ledger technology.

Introduction

In their new article “Crypto and the Evolution of Capital Markets,” Tuongvy Le and Austin Campbell trace the evolution of regulation in financial markets. They begin with a history lesson on the “Paperwork Crisis” that occurred in the 1960s when the complexity related to settling trades resulted in closed markets and billions in losses for investors and brokers. At this time, securities were physical pieces of paper that needed to be reassigned at the end of each trading day. Notably, each security was assigned to the party who rightfully owned it. With trading volumes increasing each year, back offices found they could not scale sufficiently to track the ownership of each slip of paper. These challenges led to the failure of brokerages and eventually to Congress passing the Securities Investor Protection Act of 1970 and the Securities Acts Amendments of 1975. Both of these acts were supposed to create temporary fixes to solve back office headaches but have led to the entrenchment of our current system in the US of indirect ownership (this received attention during the GameStop meme trading craze).

Incidents like the Paperwork Crisis and the creation of SIPA demonstrate the path dependence of financial regulation that has resulted in patchwork fixes and rent seeking behavior across markets. Hoping to address similar challenges with differing language has likewise created variation between different countries in terms of the roles various intermediaries play, creating challenges in expanding offerings to new markets. In their article, Le and Campbell discuss a variety of intermediaries and explain their roles and associated costs. Below we summarize these parties before discussing the even more tangled ETP space.

General Intermediaries

In this section, we discuss general parties across all asset types. In each section, we discuss how these parties will either continue to exist, evolve, or disappear in crypto markets.

Brokers

Agents that arrange trades for clients. Most investors do not have direct market access, so they rely on brokers to conduct their trades either on exchanges, directly with market makers, or through internalized flows to achieve the best execution. The quality of the execution is hard to verify and brokers are incentivized to achieve fees, giving potential agency conflicts. Examples of brokers include Charles Schwab and Robinhood.

Since all parties in crypto trading are able to access exchanges and have direct ownership of their shares, brokers do not necessarily need to exist in crypto markets, though they do make trading easier as is the case with e.g. Coinbase.

Briefly, we will say that an additional type of broker known as a prime brokers exists for institutional traders such as market makers and hedge funds. Not every investor needs a prime as they are called, but complex market participants rely on them to provide market access, leverage, and risk management. In turn, these institutional firms require their own internal back office teams to track their positions and costs to validate what they know and what their primes see. Occasionally differences due arise due to administrative and manual mistakes, leading to settlement costs, wasted time, and incorrect exposures. As firms scale, the costs of tracking and validating each transaction rises considerably, eating into the revenues of expanded trading. The costs charged by prime brokers, such as holding fees, are reflected into market maker quotes. In crypto markets, hedge funds and market makers will still need leverage but the simplified reconciliation of processes of trading reduces the cost of capital and makes trading somewhat cheaper and simplified.

Exchanges

Exchanges are the locations where buyers and sellers are matched for execution. There are two main types of exchanges: national securities exchanges and alternative trading systems

National securities exchanges are regulated in different countries to offer fair access and pricing rules, such as preventing trades occurring away from the national best bid and offer. Exchanges also monitor trading to ensure compliance with laws. Examples include the New York Stock Exchange and NASDAQ.

Alternative trading systems provide the opportunity for trading to occur directly between counterparties, effectively removing the exchange as a middleman. The orders placed on these exchanges are not visible to the public so they prevent the dissemination of information that market makers and investors would want hidden. ATSs are regulated but to a lesser extent than national securities exchanges. Examples include Intelligent Cross and Interactive Brokers.

Exchanges do not exist necessarily in the same way in the crypto ecosystem. Traders are able to transact peer-to-peer or on centralized exchanges. In the peer-to-peer case, intermediaries are fully removed, reducing transaction costs, accelerating settlement, and ensuring better inclusion into markets, though volatility and market manipulation are more rampant than regulated exchanges. Centralized crypto exchanges democratize finance by allowing everyone to have direct market access and allow trading 24/7 with significantly reduced operational costs and greater transparency. Nonetheless, as they are less regulated than traditional finance exchanges, they can allow for illicit activity or conflicts of interest from their owners. Examples include Kraken and CoinBase.

Whether peer-to-peer or on a highly centralized exchange, all trades include fees. In traditional finance, there are exchange fees, regulatory fees, transaction taxes, etc. In crypto, exchanges charge fees, but otherwise all trades require fees in terms of transaction costs (e.g. “gas” in Ethereum).

Dealers and Market Makers

These intermediaries provide liquidity on ATSs and exchanges. These parties are the ones have exchange access so they always provide bids and asks for any product, making them the counterparty to most trades. They are highly regulated to prevent market manipulation and are required to provide firm quotes. Dealers who receive customer orders are required to quote the best order they receive. These parties are not required and obviously not incentivized to charge their marginal cost for trading, so they take rents in exchange for providing liquidity. The extent of these rents depends highly on the markets they are involved in.

In crypto markets, automatic market makers can perform the role of these parties, but dealers and market makers exist to a similar extent on crypto exchanges. Without their services, the already volatile crypto markets would be considerably more so and transaction costs would reach exorbitant levels. Some market makers have presence across traditional and decentralized markets, such as Jump Trading.

Clearing Agents

For those without extensive knowledge of financial markets, these agents are probably the most opaque. Where brokers provide access to trading venues (exchanges) to trade with dealers and market makers, clearing and transfer agents manage the flow of money and securities. Clearing agents make payments and deliveries of money and securities and compare the settlement of transactions. In our current system, this clearing for equities takes place at time T+1 (one day after the trade) meaning that trades impose a holding cost on prime brokers. The delay between trade and settlement provides opportunities for failure-to-deliver of contracts, so a clearing agency can step in and act as a centralized party for all trades. Examples of these agencies include the Options Clearing Corporation who charges fees to account for the risk of negligent counterparties. The clearing corporations in each country are highly concentrated allowing for monopoly rents. In crypto trading, due to the finality of trading and transparency of ledgers, these risks are obviated so central clearing parties do not exist.

Transfer Agents

When an issuer wants to list a new security, they use transfer agents to track ownership of security holders. These parties also monitor settlement, clearance, and fraud. In crypto markets, as RWAs becoming increasingly important, transfer agents like Superstate will have an important role monitoring KYC/AML requirements, but otherwise token issuance is very simple and transparent, again making this role significantly less important and costly than in traditional finance.

Summary

In financial markets, many intermediaries exist beyond the ones listed. The rules regulating each of these parties are complex and abundant. For the most part, new rules are created to improve upon problems existing in prior markets, leading to messy rules and high costs. As temporary fixes became entrenched, large organizations like DTC have become bedrocks of our functioning financial system and have become incredibly wealthy in the process. Through processes like payment-for-order-flow and indirect ownership, market complexities have frequently shifted costs towards end investors. As we build out increasingly complex products in crypto markets, major institutions and regulators alike need to collaborate on ways we can ensure investors have access to open and fair markets without creating this duplicative work. Decentralized ledger technology has been touted as the way we can do exactly this. At Summa Protocol, we want to build ETP markets as a next step of bringing more liquidity and credibility to on-chain trading and have ideas on how we can rebuild the ETP ecosystem.

ETP Intermediaries

In past articles, we have spoken about the important role of index providers and issuers in creating and sourcing liquidity for ETPs. Above, we spoke about the importance of market makers in both traditional and decentralized markets. As with any security, their role providing liquidity for ETPs ensures that they can track the underlying fair value, minimizing costs and volatility associated with trading.

Nonetheless, in ETP markets many more intermediaries exist and extract rents. In this section, we will discuss some of these players. Keep in mind ETPs have not successfully moved over to crypto rails so the challenge for issuers, index providers, regulators, and market makers is avoiding the costly mistakes of traditional finance.

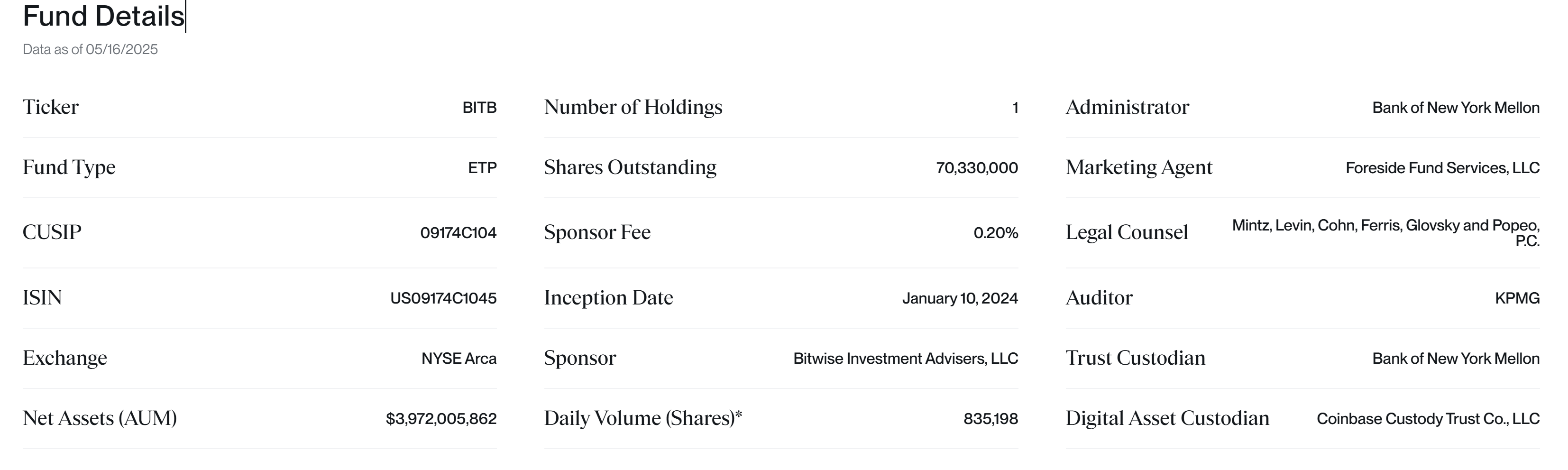

Custodians

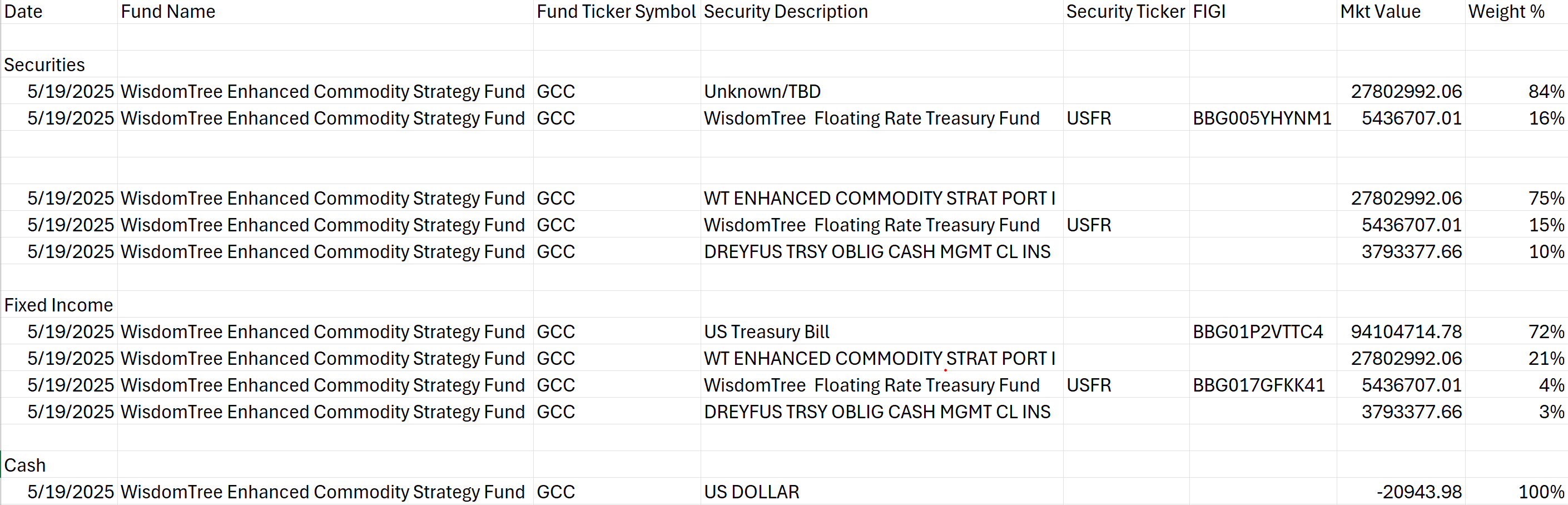

Let us take a moment before we define custodians to look at the WisdomTree Enhanced Commoditiy Strategy Fund, with ticker GCC. This ETP is an actively managed fund that tracks the performance of a handful of commodities, mainly through trading futures. The fund may also “invest up to 10% of its net assets in any combination of shares of one or more exchange-traded products that primarily hold bitcoin and in bitcoin futures contracts.” In other words, the fund holds equities and futures, with some futures listed outside of the United States. Below we see an image of one day of holdings:

What does this thing actually hold? I am not bringing this fund up to critique WisdomTree’s dissemination of holdings, as they actually have a very comprehensive list available. Instead I am sharing this to show how funds might actually hold securities for optimal tax advantages (page 97).

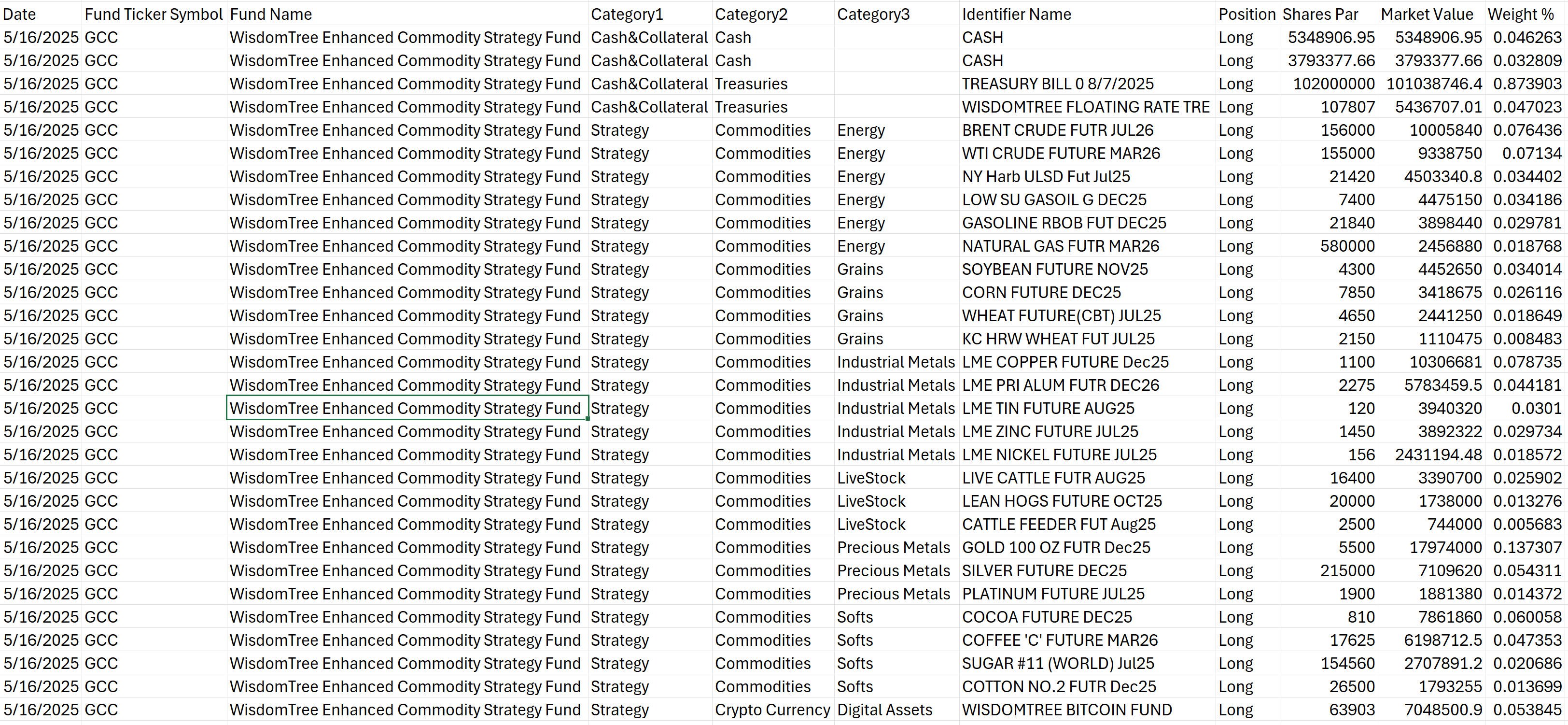

Basically after ignoring some of the way this is written, we see that this fund holds cash (and highly liquid fixed income instruments) and WT ENHANCED COMMODITY STRAT PORT I, which is a Cayman Island based subsidiary of the fund that conducts much of the commodities trading. Below, we can see what this subsidiary actually holds.

In the case of funds such as GCC, tracing ownership—though covered in prospectus materials—can be somewhat complicated. In the case of digital assets, the ownership can get somewhat more complicated and costly.

As an aside, we see in the last row that the fund holds WISDOMTREE BITCOIN FUND, otherwise known as BTCW. GCC, a WisdomTree fund, holds another WisdomTree fund, which is a common practice amongst issuers to receive more fees and reduce costs of transacting physical Bitcoin or Bitcoin futures. We make note of this to demonstrate that a fund holding another fund is not a new invention, strengthening our belief that as more ETPs become tokenized in crypto rails, investors can still trade traditional ETPs to gain their exposure as we discuss here.

Due to the risks associated with holding digital assets (permanence of transactions and dangers of losing private keys), pretty much any fund holding crypto relies on third parties to actually act as custodians. We can even see this in more traditional asset classes like IVV.

Unlike other equities which do not actually hold anything, ETPs rely on third parties who can charge around 1bp of AUM. The third party is required to disintermediate trust directly from issuers, but we foresee this is an unnecessary role that could be occupied by a smart contract.

Administrators

ETF administrators manage the day-to-day operational aspects of an ETF, ensuring compliance, accuracy, and efficiency in various areas like accounting, reporting, and regulatory filings. They work behind the scenes to make sure the ETF functions smoothly and complies with all necessary regulations. In a world where code is law and markets are fully transparent, this role is again an unnecessary cost to issuers.

Auditors

In many funds, and especially in crypto where vaults are held with utmost secrecy, auditors perform the important role of providing credibility to funds and ensuring regulatory compliance. Holdings can be far from transparent, especially when funds hold complex swap contracts (see our discussion of BDRY). The role of the auditor is to confirm the fund holds exactly what they claim to hold and are disbursing cash in accordance with regulations. This role can again charge around 1bp.

NAV Calculation Agents

Each day, the fair value of the fund needs to be calculated. Other assets do not necessarily have fair values, and some assets such as ETPs that hold flex options or international equities do not have the most straightforward pricing. The role of NAV Calculation Agents like Kaiko provide these services, again charging a certain rate on AUM.

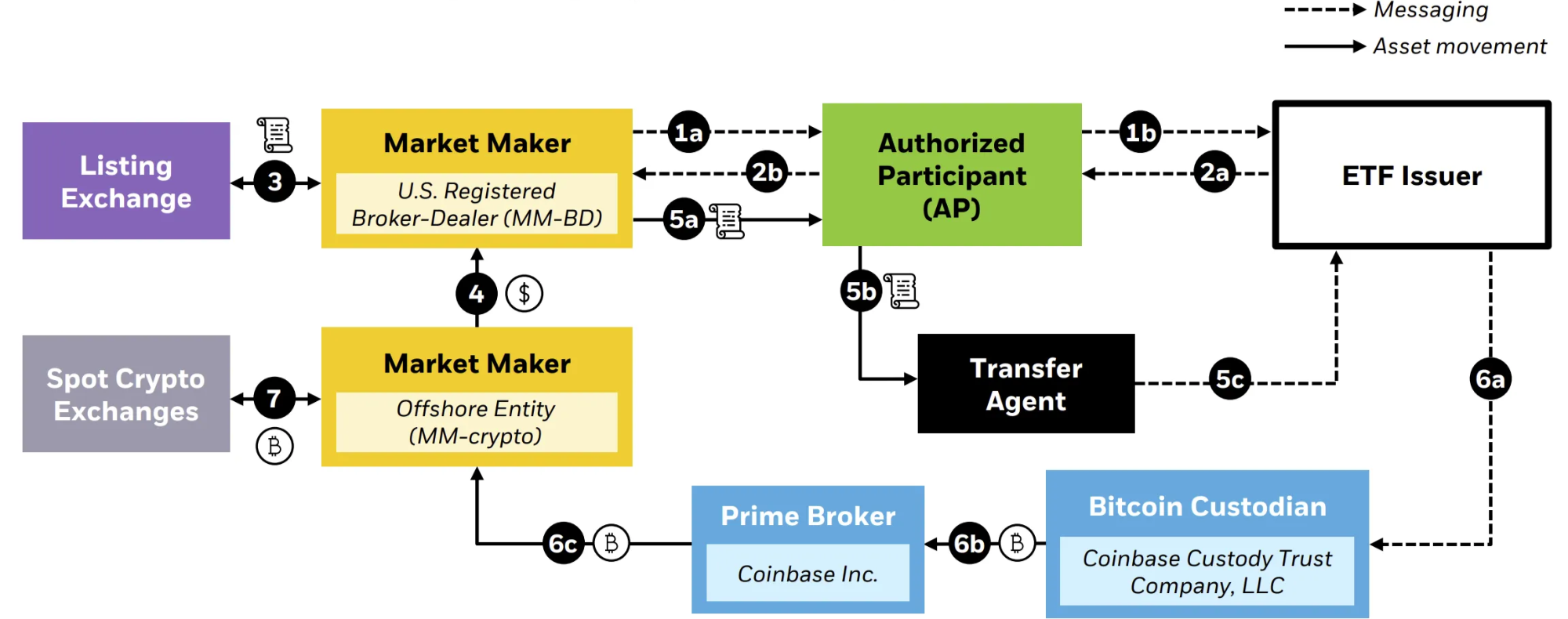

Authorized Participants

Authorized participants (APs) are the last intermediary we will discuss specifically related to ETPs, and they are definitely the most interesting and probably opaque to most people even familiar with financial markets. ETPs have a unique characteristic known as the creation/redemption mechanism that keeps their prices in line with their NAV. Many market makers exist to make sure that they are appropriately quoting the price of ETPs. However, only a few players in the entire ETP ecosystem have the ability to conduct this type of transaction. These are the largest banks like Goldman Sachs and BAML as well as massive hedge funds like Citadel and Virtu. The reason these few firms are approved for creation/redemption orders is their massive balance sheets, but the fact that the orders clear constantly demonstrates that smaller levered firms which make up the plurality of market makers (though not the majority of volumes) have the ability to conduct these transactions.

With their restrictive access to creation/redemptions, these firms have the ability to charge large fees of up to multiple percentages of the total flow of the creation/redemption orders as well as considerable fixed fees. These costs can make market-making certain funds prohibitively costly. The role of the AP is combined with a transfer agent to make sure underlyings (whether cash or actual securities) are successfully exchanged for ETP shares. As passive investing moves on-chain, we believe this multi-billion dollar space is ripe for innovation.

Brief discussion of compliance

All the parties discussed above have to conform to their own unique regulations. These regulations are important, aiming to help investors be sufficiently protected from adverse selection, market manipulation, and risk. Nonetheless, many regulations result in additional costs in terms of regulatory body fees and legal counsel. As trading moves increasingly onto crypto rails, many of these regulations, specifically ones made to protect end investors from unwise investments and anti-money laundering/terrorism rules will persist, as will the importance of lawyers and organizations such as the SEC. Nonetheless, we imagine the transparency provided by crypto markets will make many old regulations irrelevant. We continue this discussion in our piece on UCITS.

Conclusion

Financial markets have many intermediaries. ETP markets have even more. Each layer of complexity has a purpose and associated costs. With the chance to remake finance using decentralized ledger technology, we should take a look at each layer of complexity and regulation to rebuild them to be both more transparent, streamlined, and cheap.